Pesapal is a leading payment services company with local know-how in building payments and business tools for Africa. Since 2009 we’ve empowered thousands of African businesses to collect money online and in person via mobiles and cards. This has been made possible by popular digital tools for ticketing, reservations, reporting, inventory, merchant credit, APIs, and more, processing up to 12 million transactions a month.

Our payment processing innovations allow you to generate the highest possible income or sales for your business or organization. The goal is to increase the amount of revenue you generate, often through payment channels associated with your business. Opening a Pesapal merchant account is the first step to allowing you accept multiple payment methods and maximize your business revenue.

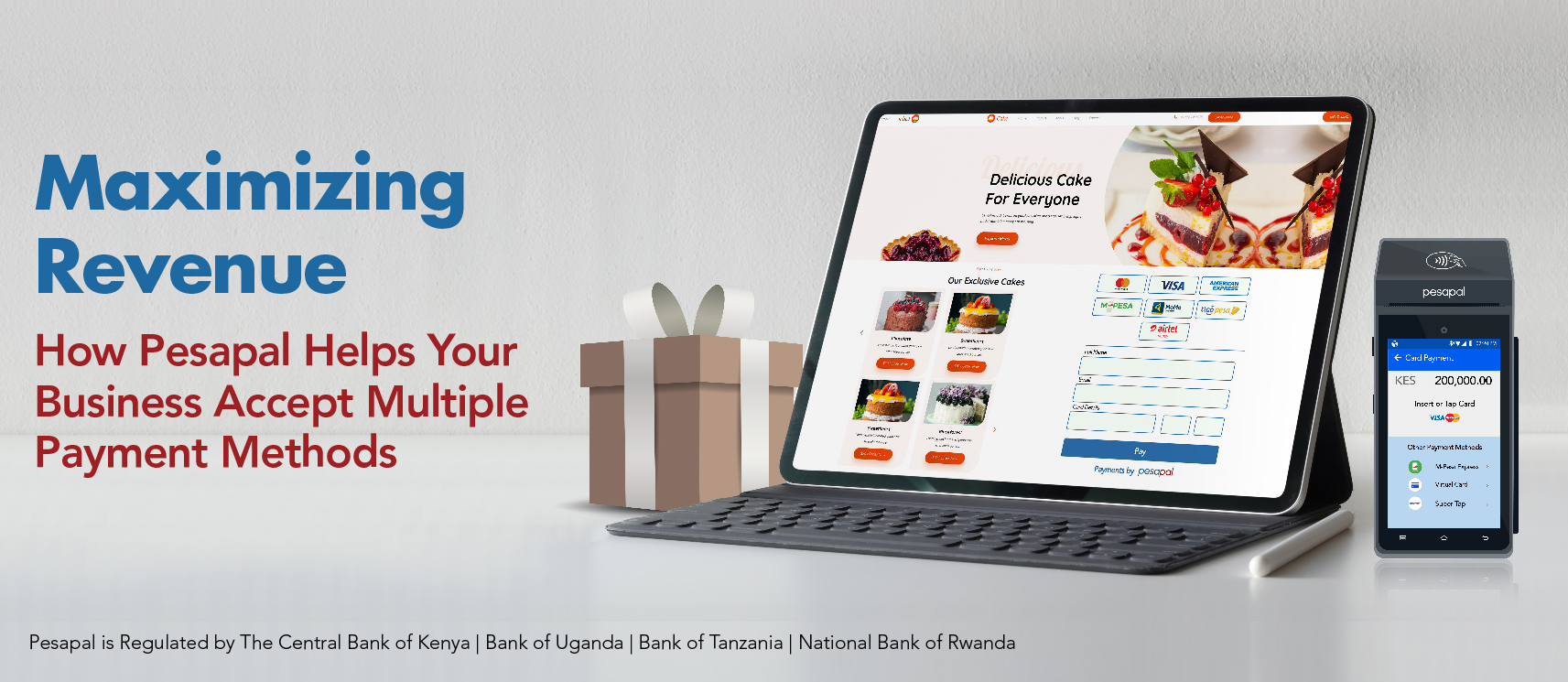

Sabi POS terminal

Our Sabi POS terminal helps your business to maximize revenue by allowing you to accept electronic payments from your customers. It has a card reader, a keypad, and a screen that displays the transaction details. When a customer makes a payment, the terminal securely processes the payment and records the transaction in your merchant dashboard. Here are some of the methods accepted;

Card payments

Millions of people across the world have embraced the idea of going cashless and thereby adopted card transactions for shopping and bill payments. Accept Visa, MasterCard, and American Express payments from customers and get paid directly to the bank account linked to your merchant account with our payment solutions.

Mobile money payments

Our platform allows you to accept M-Pesa, Airtel money, Tigo Pesa and MTN mobile money payments from customers keen on using mobile money technologies to transact. Mobile money offers a fast, secure way for customers to pay for goods or services using their mobile devices. The Sim Application Toolkit (STK) push technology prompts the client to input their pin and allows the transaction to quickly be processed into your merchant dashboard, this ensures speedy service delivery and improves your customer experience.

E-wallet

The E-wallet interphase allows your clients to pay conveniently from their Pesapal personal account. Creating an e-wallet is particularly important for clients who would not wish to share their personal details while making online purchases. Once a client creates an e-wallet, they may securely top it up using mobile money options like M-Pesa and Airtel money.

Virtual cards

Virtual cards present a type of payment card that exists only in digital form. They come with a unique-digit card number, expiration date, and security code that can be used for a single transaction within a specific time or period. Charge virtual cards on Reserveport and from OTAs like Agoda and Booking.com and process card payments for your corporate clients in your local currency as well as USD by using the Sabi POS terminal. Virtual cards offer increased security as well as fraud prevention as their validity is timed and cannot be reused.

E-invoices

You can maximize your business revenue by creating and sending e-invoices directly to your client’s email addresses. Once the invoice is received, customers can pay for goods and services sold via card as well as mobile money and e-wallet options.

Discover how to maximize your profits and stay ahead of the competition with our innovative payment solutions. We offer 24-hour customer support to allow you to focus on running your business and improving customer experience.