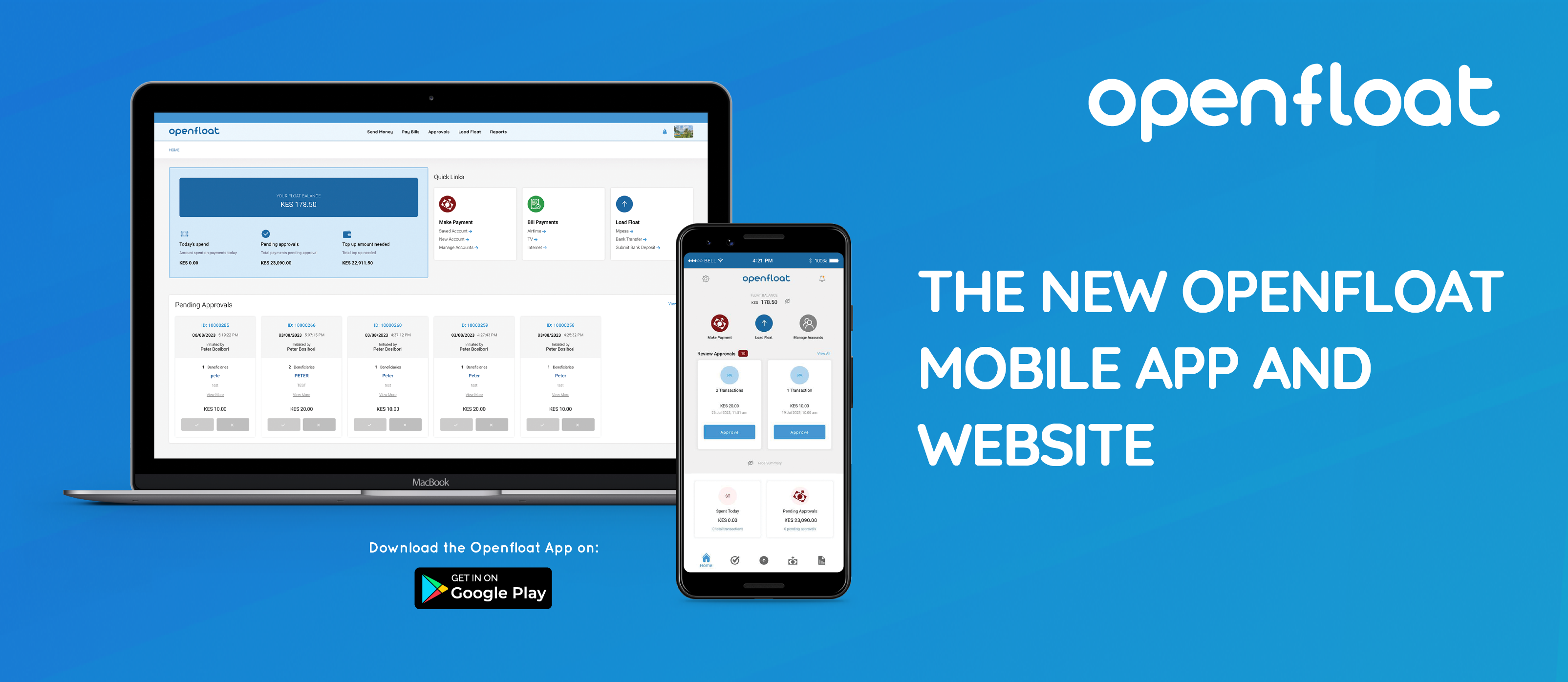

Nairobi… Pesapal, a leader in building payments and business tools for Africa, has updated its innovative expense management platform - Openfloat. The update includes the launch of a new Openfloat Mobile App for Android devices and a revamped website to simplify expense tracking and management across multiple accounts, channels, recipients, and currencies.

The app will also provide merchants with a user-friendly interface, allowing them to manage multiple payment streams and track day-to-day spend all on one platform. Additionally, the Openfloat website has been revamped to provide businesses with a seamless online experience, making it easier to access and utilize the platform's features.

The updates introduce a range of powerful features to simplify payment processes and enhance overall payment management capabilities for our merchants, Pesapal CEO Agosta Liko said.

"From small start-ups to multinational enterprises, our solution scales to fit every need, bringing a new era of financial management. It will now be much easier for merchants with multiple branches, franchises, or various business entities to manage multiple accounts from a single platform," Mr. Agosta said.

The new Openfloat App and revamped website offer several new features, including:

In addition to simplifying the payment process, merchants now have the option to save accounts they frequently make payments to under 'saved accounts,' allowing them to create groups comprising these saved accounts. They can then conveniently send payments to these groups and customize amounts for individual accounts or all at once. Additionally, this entire payment can be assigned to a specific payment category, which proves beneficial for reporting and payment management purposes.

Openfloat is a business solution that digitizes petty cash, payroll, and corporate bill payments. The solution enables businesses, especially Small and Medium Sized Enterprises (SMEs) and large organizations, to disburse funds, pay bills, and buy airtime in bulk — all in one place. In addition, they can now disburse payments via pay bills, tills, mobile numbers, and bank transfers, all from the same account.

Merchants using Openfloat enjoy various benefits, which include payouts to bank accounts and mobile money. One can view transaction reports and track their cash flow in real-time.

Ends-

About Pesapal Ltd

Thousands of businesses and customers trust us to simplify and secure their payments. Founded in 2009, we're the leading payment services company with local know-how in building payment and business tools for Africa. Pesapal has 300+ people in 5 African countries – and we're adding more. We're on track to connect a million African entrepreneurs and customers to e-commerce, digital payments and the global financial system by 2030.

Pesapal is regulated by The Central Bank of Kenya, Bank of Uganda, Bank of Tanzania and National Bank of Rwanda.

For media enquiries, contact:

Renee Ng'ang'a

Marketing Manager