Digitization of payments has been a huge jump toward the goal to achieve an easy, convenient, fast, and secure payment method. Arguably, we have achieved all of it.

Today, more transactions are online. Statista reports that in 2020, digital and mobile wallets accounted for roughly 45 percent of global e-commerce payment transactions, making the digital wallet by far the most popular online payment method worldwide. This share is set to increase to over 50 percent in 2024.

Digital payment methods have seen massive developments in the span of four to five years and we are about to see even more changes in the coming future. Unfortunately, as more transactions move online, instances of fraud such as identity theft have been on the rise.

According to the 2017 Data Breach Investigations Report released by Verizon, 81% hacking-related breaches leveraged either stolen or weak passwords.

To ensure confidence and trust in digital payment platforms and safeguard consumers from any fraud, industry players have continued to innovate to find solutions.

A One Time Password or OTP is the current security feature that service providers have added as a measure to prevent online fraud during online transactions.

The wheels of e-commerce, payment services, banking, and a lot more are today dependent on an OTP to authenticate their customers’ transactions or log in details.

What is OTP?

A One Time Password or OTP is a security code designed to be used for a single login attempt, to minimize the risk of fraudulent login attempts and maintain high security. It’s a string of characters or numbers automatically generated and sent to the user’s phone via SMS, Voice, Push message or email.

OTP is a form of two-factor authentication (2FA) and sent to a user's mobile device via SMS or Voice which is then used to verify the user's identity in order to protect online applications and data.

Unlike static or user-generated passwords, an OTP adds an extra layer of security. For example, the Pesapal app generates a dynamic OTP valid for 30 seconds. Other organizations, like banks, give you a window that may be between 1-5 minutes.

Has Pesapal Introduced OTPS?

Yes. Pesapal introduced OTPS as a security feature in 2022 for both credit card transactions and mobile transactions to safeguard our customers and merchants. If the user's bank has 3D secure, the OTP will be enforced. If not, it will use the normal cyber source standard.

OTPs act as a deterrent for online fraudsters since they will need to have your credit card and your registered mobile number or email address to be able to generate the OTP. This makes it more difficult for them to commit fraud. With OTPs in place for credit card transactions, this will hopefully minimize the number of fraud cases.

How does OTP work?

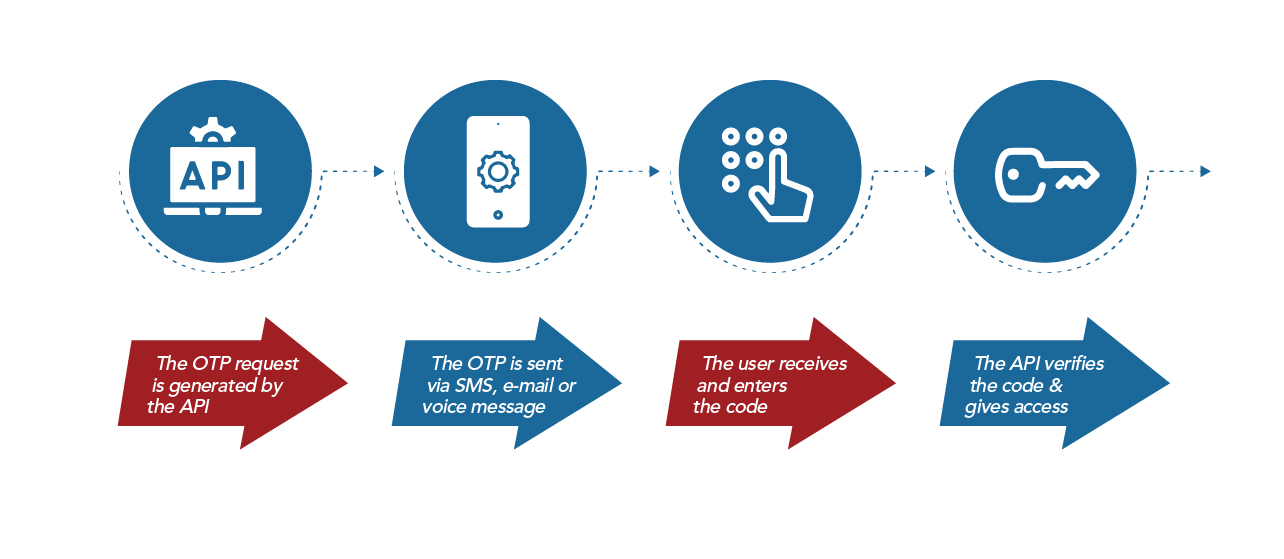

Through the use of OTP, users need to go through an extra step in the login process or payment transaction to prove that they are the legitimate owners of the account. When triggered, the app or website will require a password before pushing through with a transaction.

Each OTP is unique and generated right at the moment of transaction, preventing hackers with access to your login credentials from stealing from your account or e-wallet.

How to Keep your OTP private

Limit your trusted devices. It’s best to limit your account to one linked device.

Report theft at once. Since OTPs are linked to your mobile number, any change in mobile number has to be reported to your account administrator especially if your mobile phone gets lost or stolen.

What are the benefits of OTP?

There are many benefits of OTP while making payments. Here are some benefits:

Yes. OTPs add an additional layer of security to static passwords. Passwords alone are a vulnerable form of identity verification, responsible for 81% of security breaches. Adding another layer of authentication to passwords ensures better security.

Do I get charged for requesting an OTP?

OTP is generated free of cost. So, you won’t be charged for generating an OTP.

Can someone misuse the OTP?

Yes, they can. It’s recommended not to share your OTP with anyone. If you get an OTP that you didn’t request, contact Pesapal customer service and report the activity.

How Does Our OTP API Work?