Pesapal is synonymous with processing card and mobile money payments for online and in-person payments. Reaching this far has been a long journey full of ups and downs.

While the company has celebrated many achievements, it has experienced its fair share of setbacks. Pesapal Founder Agosta Liko, in an interview with Moses Kemibaro, the CEO of Dotsavvy, explains the transformational journey that has earned the company a place on the fintech map.

Necessity, as always, is the mother of invention. The 2007 post-election violence in Kenya, followed by the global financial crisis, forced businesses to cut operational costs. Agosta and his colleagues decided to build a travel network. The team banked on East Africa being the leading tourist destination to make a dime at a time when most companies were struggling.

“The idea was to build a product that could sell even if the offices were closed; To keep earning money. So, we built a travel network so that anyone who wanted to tour East Africa would search for their travel option.” Noted Agosta.

The greatest challenge that they faced was getting a proper payment gateway to process transactions on the platform. The team had to set up accounts on different platforms to process payments, but unfortunately, those accounts were shut down for various reasons. The team successfully built a payment gateway inspired by the urge to have customers pay directly on their platform. However, the journey was not as promising as they thought. In the first year, the company only processed three transactions.

Pesapal broke the glass ceiling in 2010 when the company completed 156 transactions up from 3 transactions. This is after the company landed a job with Access Kenya to design a platform to sell online tickets. According to Agosta, he thought the future was ticketing after the breakthrough. This birthed Ticketsasa.com, the leading ticketing platform for events, flights, and holiday packages.

“We built Ticket.pesapal.com; our first client was Access Kenya; we sold 156 tickets. That was pretty successful, and we thought the future was ticketing. So Ticket.Pesapal.com became what is Pesapal today.” He recalls.

Ticketsasa laid the foundation for Pesapal, ushering in an era where businesses can get paid online or in-person at the push of a button. At this moment, infrastructures were put in place to ensure a seamless process. However, the process has undergone continuous improvements over time.

First forward, in 2011, Pesapal signed the first merchant, Rupu, an E-commerce company that offered small and medium businesses a platform to market their goods and services. Two months later, we signed Zuku, who played a critical role in the growth of Pesapal.

“Zuku opened doors for Pesapal. It helped us build a whole team, processes, settlement, and risk. They made it easy to get into a new country and make a setup.”

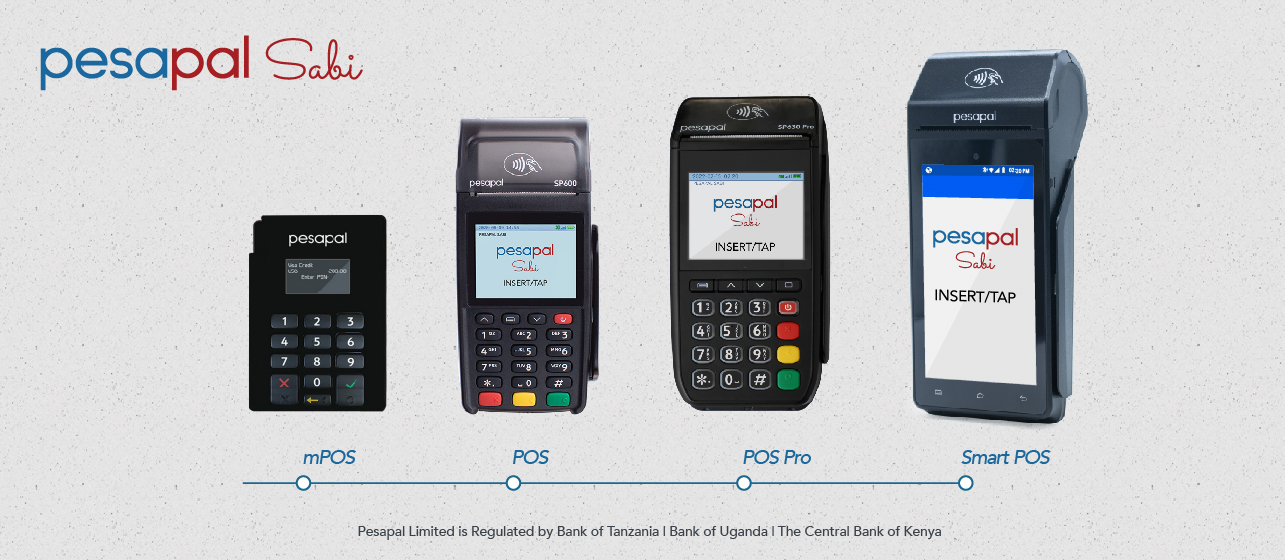

The Pesapal Sabi POS is a countertop PDQ machine that processes card and Mpesa payments in local and international currency. Maybe you have been wondering why the name Sabi. Sabi means to “know or understand”. As the name suggests, Pesapal Sabi has gone overboard to help business owners to understand more about their business in terms of reconciliation, sales reports, and combating fraud.

“Sabi is pidgin for know or understand. So we try to build a platform whereby we can help a business owner get a general understanding of what is going on.”

Traditionally, point of sales, such as Oracle Micros, Compulynx, and Microsoft AMX, were standalone systems. They operated separately, leading to a fragmented experience, greater time consumption, and challenges connecting the dots between different departments in the organization. Pesapal Sabi was developed with business owners in mind making it possible to integrate with existing software at the premises. The integration ensures that entrepreneurs can run profitable businesses while delivering outstanding experience.

Pesapal has diverse payment options that have enabled tour operators and travel agents to get paid online. In addition, we have made it easy for tour operators to get paid in both local and international currencies remotely. During Covid, travel restrictions across the globe meant no business in the tour sector. Agosta notes that during this time, E-commerce exploded in different parts of the world as customers opted to shop online. However, in East Africa, E-commerce platforms continued to struggle. As a result, Pesapal had to develop an online ordering platform that enables restaurants to receive orders directly on their website.

Pesapal has demonstrated resilience over the years. Operating in the financial services sector ultimately means that you have to work closely with the stakeholders in the industry. Government, through the Central Bank, has been a key stakeholder in our respective markets. It has provided a set of rules and regulations that ensures merchants' money in our ecosystem is safe. To ensure it plays the watchdog role effectively, the central bank requires PSP companies to apply for a license. Four years ago, Pesapal started a journey of getting licenses, and today we are regulated by the Central Bank of Kenya, Bank of Uganda, and Bank of Tanzania.

Listen to the podcast for the whole story here

Manage all your payments with Pesapal POS for faster transactions

START NOW