The traditional methods of handling corporate payments have long been criticized for their bureaucratic nature and sluggish pace. However, in recent years, a transformational shift has occurred, thanks to the adoption of digital payment methods.

These innovations have indeed saved the day revolutionizing the way businesses manage their financial transactions.

Traditional corporate payment processes

Traditional corporate payment processes have often been characterized by files of paperwork, manual approvals, and lengthy delays. Let's look at some of the key pain points associated with these old-fashioned methods.

In the past, payments often required extensive documentation and the physical transfer of checks or invoices. This reliance on paper not only wasted time but also increased the risk of errors, loss, or fraud. Shocking right? There's more. These traditional systems demanded multiple levels of approval, often leading to bottlenecks. Each layer of authorization added more time to the payment processing cycle.

Traditional methods also restricted payment initiation to the office, making it challenging to facilitate payments when employees or stakeholders were away from their desks.

Digital Payments: The Savior of Corporate Finance

Digital payment solutions have transformed the landscape of corporate payments today, addressing the limitations of traditional methods head-on. Payments can be transferred within seconds, reducing the time and resources wasted on manual processing. Routine tasks such as invoice matching, approval workflows, and reconciliation can be automated, reducing the need for human intervention.

Furthermore, these digital payment platforms are equipped to handle real-time tracking and reporting, providing corporations with unparalleled visibility into their financial transactions, improving decision-making and reducing the risk of errors.

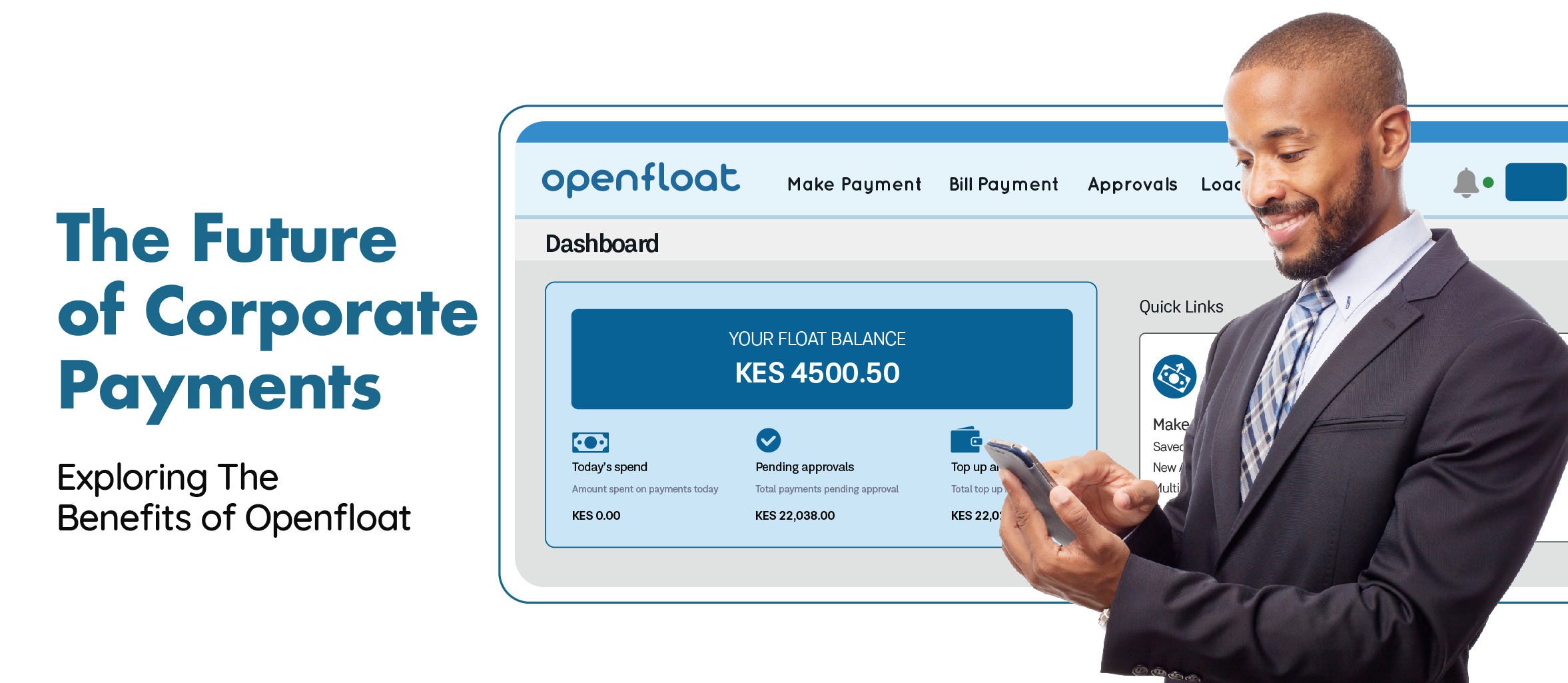

Exploring the Benefits of Openfloat

Openfloat by Pesapal is a cloud-based system and mobile app that allows for payments to be initiated and authorized from virtually anywhere, promoting flexibility and remote work capabilities. The system digitizes petty cash, payroll and corporate bill payments. You can disburse funds, pay bills, and buy airtime in bulk all from a single platform.

We have adopted the latest innovation with cutting-edge features that are set to transform how you manage your enterprise today and in the future.

Let us explore the exciting capabilities and accompanying tools that can have a profound impact on your business.

Openfloat simplifies bookkeeping by providing a user-friendly platform combined with powerful automation features, ensuring a significant reduction in disbursement errors. Through automation, it becomes easy to categorize transactions into revenue, expenses, assets, and liabilities, saving you valuable time while centralizing your record-keeping on a single platform.

Additionally, you can conveniently make direct payments to suppliers, employees, and vendors without the need to leave the platform, ultimately boosting operational efficiency.

We understand that tracking financial records is a critical component of effective financial management, however, accurately monitoring expenses can be equally challenging, especially when dealing with cash transactions or multiple payment methods. Openfloat handles the difficulties that can result in inaccuracies in your financial records, allowing you to focus on running your business.

Budgeting is another fundamental aspect of financial management that Openfloat supports. Creating and maintaining an accurate budget can be particularly challenging for businesses with fluctuating revenue streams or those experiencing seasonal sales variations. Nonetheless, an accurate budget is a vital tool for helping businesses plan their expenditures and manage cash flow effectively.

Openfloat offers robust reporting and analytics capabilities allowing you to effortlessly generate key financial statements such as cash flow statements and summaries. These reports provide insights into making informed decisions and closely monitoring your business's financial performance.

Moreover, the accounting feature allows you to review transaction and account activities, serving as a deterrent against fraudulent behavior. By enhancing the precision of your financial records and optimizing cash flow management, Openfloat gives your business a distinct competitive advantage within your industry.

What is the Future of Corporate Payments?

The days of waiting weeks for a payment to clear or drowning in paperwork are fading into history. Today, you can operate with agility and confidence, knowing that financial transactions in your business are secure, simple and efficient.

Digital payment methods have indeed saved the day for corporate finance, making it easier than ever for businesses to thrive in a rapidly evolving financial landscape.