Payment links are emerging as a popular solution, enabling businesses to accept payments quickly and easily without the need for a physical terminal.

According to recent statistics, the explosive growth in global e-commerce during the first two years of the pandemic cooled in 2022, with global e-commerce transaction value growing by 10% from 2021 to 2022, reaching nearly $6 trillion. However, the trajectory is expected to grow with all factors remaining constant.

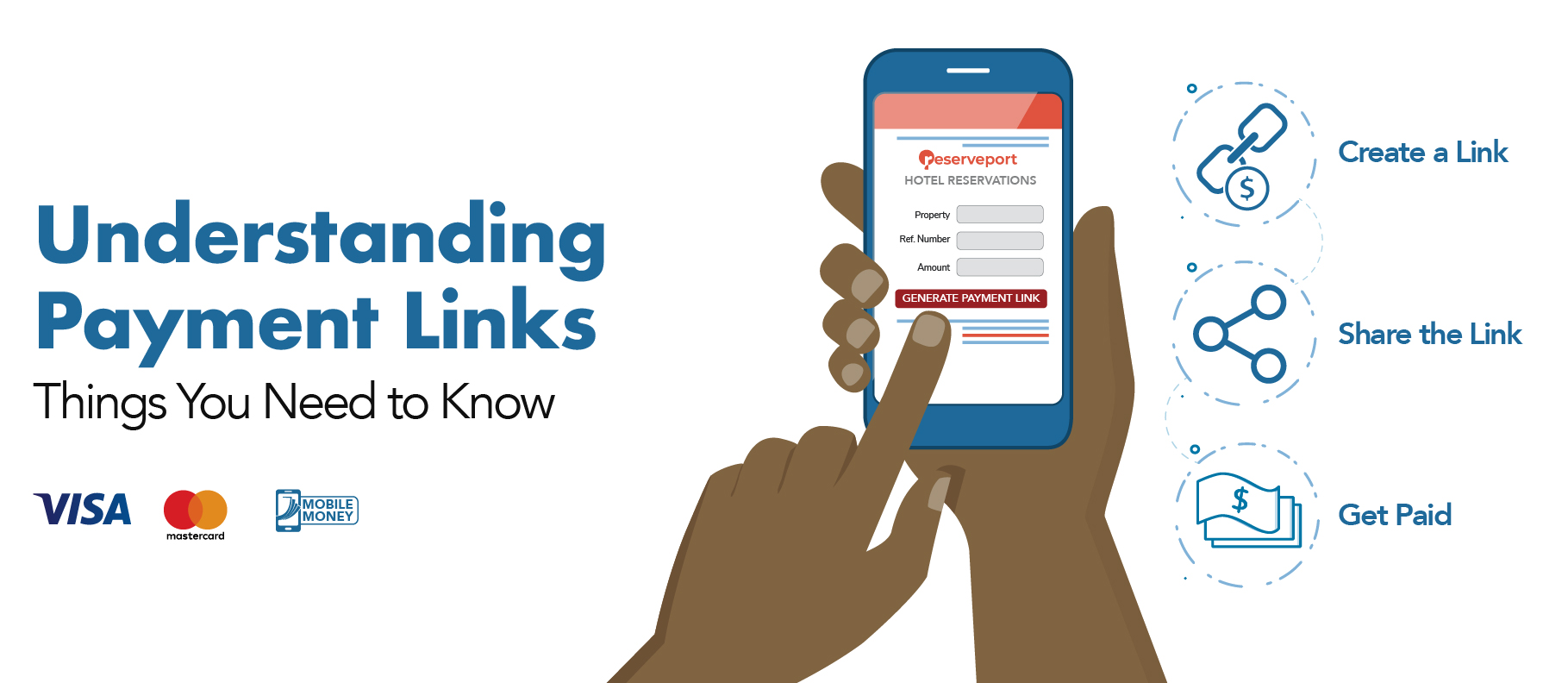

A payment link is a secure Uniform Resource Locator (URL) that allows businesses to accept online payments from customers without the need for a physical point-of-sale (POS) terminal. Payment links direct customers to a payment gateway or a payment processor's website, where they can enter their payment information to complete the transaction. Payment links can be sent via email, text message, social media, or any other digital platform. Customers can simply click on the link to initiate and complete the payment process. When a client clicks the link, he's directed to the merchant's online checkout page to complete the transaction.

Pesapal has developed two types of payment links to empower businesses to get paid online E-invoicing, or electronic invoicing, is a payment solution by Pesapal that enables merchants to send and receive invoices electronically over the internet rather than through traditional paper-based methods. On the other hand, the payments Page is a secure web page that enables merchants to accept online payments. After adding the items to the shopping basket, the user must be redirected to the payments page, select the payment method, and insert the data necessary for the successful operation. This procedure is commonly done on the website where the consumer orders items/services. The payment options include Visa, MasterCard, American Express, and mobile money in your local currency and US dollars.

Here’s how to generate and send your invoice

There are several benefits of using a payment link to receive payments. Some of the key benefits include:

Convenient and easy to use: Payment links allow customers to make payments quickly and easily with just a few clicks. They don't have to navigate through a complicated payment process or enter much information, which can lead to higher conversion rates and fewer abandoned transactions.

Versatile: Payment links can be used for a variety of transactions, including one-time payments, recurring payments, and invoices. This makes them a versatile tool for businesses of all sizes and types.

Secure: Payment links are typically processed by secure payment gateways, which use encryption and other security measures to protect sensitive customer information. This gives your customers peace of mind and protect your business from fraud and chargebacks.

Improved cash flow: Payment links improve your cash flow by allowing you to receive payments more quickly and efficiently. This helps you manage your finances more effectively and reduce the risk of cash flow problems.

When choosing a payment link provider, several factors must be considered to ensure you select the right provider for your needs. Some key considerations include:

Fees and pricing: Different payment link providers may charge different fees and have other pricing structures. It's important to compare the prices of various providers to ensure you're getting a good deal.

Payment methods: Payments link providers may offer different payment methods, such as credit cards, debit cards, bank transfers, and digital wallets. Make sure the provider you choose offers the payment methods your customers prefer. For example, Pesapal processes major cards: Visa, Mastercard, and Amex; we also process mobile money, Mpesa, Airtel Money, MTN, and Tigo Pesa.

Integration options: If you use other software or tools such as an e-commerce platform or accounting software, you'll want to ensure that the payment link provider you choose can integrate with these tools. Pesapal has a dedicated team to assist merchants in integrating our payment solutions with existing internal software to ensure seamless payments.

Security: Security is a critical consideration when choosing a payment link provider. Make sure the provider you choose uses secure payment gateways and has robust security measures in place to protect sensitive customer information. With the increased technological advancements, business owners and customers are becoming more vulnerable to fraudsters. To curb this trend, Pesapal has employed state-of-the-art measures to ensure customers' card details and merchants' money within our ecosystem is safe.

Customer support: Good customer support is essential if you encounter any issues or have questions about using the payment link provider. Ensure the provider you choose offers good customer support and a responsive support team. Pesapal has a dedicated customer support team that is available 24/7. This is a valuable asset when using our payment link provider; it ensures that you receive the support you need to use the service effectively.

Reputation: The reputation of the payment link provider is another important consideration. Look for reviews and ratings from other businesses to get an idea of the provider's track record and level of customer satisfaction.

When implemented correctly, payment links are a safe and secure way to make and receive payments online. However, as with any online transaction, there are some potential risks to be aware of. To ensure the safety of link payments, it's important to choose a reputable payment processor with strong security measures in place. Payment processors use encryption and other security protocols to protect customer information, such as credit card details, from being intercepted or stolen by hackers or other unauthorized parties.