Mpesa payments have emerged as a dominant mode of accepting payments for various businesses in Kenya. This revolutionary mobile money platform has gained widespread popularity and trust among consumers, making it the go-to choice for transactions.

With the integration of Mpesa payments, businesses no longer need to rely solely on cash transactions. This has helped them tap into a vast customer base that prefers the ease and simplicity of mobile payments. The widespread adoption of Mpesa payments showcases its effectiveness in meeting the needs of both businesses and consumers, solidifying its position as a widely preferred mode of accepting payments in Kenya's ever-evolving market.

Mpesa has become more than just a convenient alternative to traditional payment methods. It has ushered in a wave of exciting side effects that are gaining momentum among target consumers. Customers no longer need to walk with a huge amount of money, their mobile device is all they need when shopping, dining, or parting.

Like any other payment solution, receiving Mpesa payments presents its own set of challenges for business owners. As businesses strive to accommodate a wide range of customer preferences, they often find themselves using multiple payment terminals to cater to various payment methods such as cash, Fitbit, Apple Pay, Google Pay, and Mpesa. This can become cumbersome and costly, requiring additional resources to manage and maintain these different devices.

Furthermore, the challenge of reconciliation arises when each terminal generates separate transaction records, making it difficult for businesses to consolidate and reconcile their finances accurately. This fragmented approach to payment acceptance can lead to inefficiencies, errors, and increased administrative efforts.

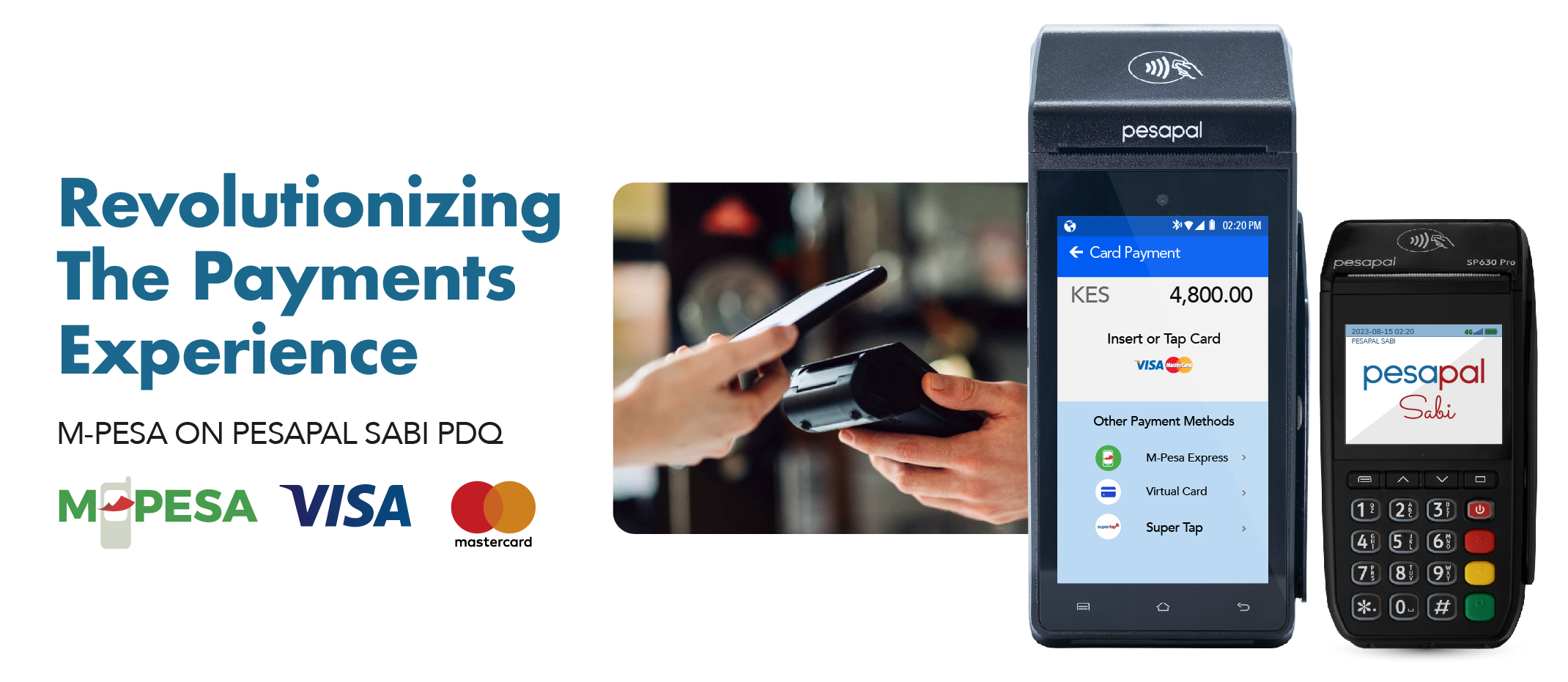

To address these challenges, businesses can explore integrated solutions that consolidate different payment methods into a single platform, simplifying reconciliation processes and streamlining the management of various payment types. For instance, the Pesapal Sabi PDQ accepts both card and Mpesa payments on a single platform, ensuring that businesses don't miss out on any potential sales. By offering a consolidated payment solution, Pesapal's PDQ machine eliminates the need for businesses to invest in multiple terminals, simplifying their operations and reducing costs.

The PDQ also comes with a superior merchant dashboard that provides comprehensive transaction reports separately for Mpesa and card payments. This allows business owners to access detailed insights into their payment activities, aiding in better financial management and decision-making. With the Pesapal PDQ machine, businesses can easily send push notifications to customers, prompting them to complete their payments conveniently. This integrated solution not only enhances the customer experience but also streamlines the reconciliation process, making it a valuable asset for businesses of all sizes in Kenya.

In our blog, we explain how accepting Mpesa and card payments is transforming the business experience in unexpected ways.

By enabling entrepreneurs to accept Mpesa and card Payments provides businesses with the opportunity to encourage upselling and cross-selling, ultimately boosting their revenue. By offering multiple payment options, businesses can create a seamless and convenient purchasing experience for customers. When customers have the flexibility to choose between card and Mpesa payments, they are more likely to make additional purchases or upgrade their orders, leading to upselling.

For example, customers who initially intended to make a basic purchase because of insufficient amounts in their card may be tempted to upgrade to a higher-priced product or add a complementary product if they realize they can top up with mobile money. Similarly, cross-selling opportunities arise when businesses leverage the convenience of accepting both card and Mpesa payments. They can suggest related products or services that complement the customer's initial purchase, increasing the average order value. By embracing a diverse payment ecosystem, businesses can effectively capitalize on upselling and cross-selling opportunities, enhancing their profitability and strengthening customer relationships.

The Pesapal Sabi PDQ provides businesses with valuable real-time sales reports, empowering merchants to track their sales, generate comprehensive reports, and gain valuable insights. This feature enables businesses to make data-driven decisions regarding sales strategies and customer engagement. By analyzing sales data, businesses can identify trends, preferences, and popular products or services, allowing them to tailor their offerings to better meet customer demands. Moreover, the availability of transaction records simplifies accounting processes by providing accurate and detailed information about each transaction. This ensures transparency and streamlines the reconciliation of finances, ultimately saving businesses time and effort. With access to real-time sales reports, businesses can optimize their operations, improve profitability, and deliver a more personalized experience to their customers.

Mpesa payments have experienced rapid growth across all demographics in Kenya and have become the primary payment source for many young adults. Moreover, it is predicted that Mpesa will continue to dominate as the primary payment source for future generations. This shift in payment behavior can be likened to the emergence of websites two decades ago. Initially, only a few businesses recognized the importance of having an online presence, but now having a website is considered a necessity for businesses of all sizes. Similarly, Mpesa has transformed the way transactions are conducted, providing convenience, security, and financial inclusion. As the younger generations who are already accustomed to mobile payments become the dominant consumer base, Mpesa will undoubtedly solidify its position as the go-to payment method. Businesses that embrace this trend and adapt to accepting Mpesa payments will be well-positioned to cater to evolving consumer preferences and thrive in the digital era. Just as having a website is essential for businesses today, accepting Mpesa payments will become a fundamental requirement to meet customer expectations and remain competitive in the future.

One of the most exciting features of Mpesa on Pesapal Sabi PDQ is the ability to conduct quick, convenient, and secure transactions from anywhere and at any time. This feature empowers merchants to engage with customers who may not be physically present at their premises but still want to make a purchase. With simple push notifications, merchants can notify customers about the products or services they offer, prompting them to initiate the transaction remotely. Customers can then conveniently complete the transaction by inputting their Mpesa PIN, ensuring the security of their payment information. This functionality opens up new possibilities for businesses to expand their reach and cater to customers beyond the limitations of their physical location. It enhances convenience for customers and provides an additional avenue for merchants to generate sales, fostering greater customer engagement and boosting overall business growth.

The introduction of Mpesa payments on the Pesapal Sabi PDQ has significantly contributed to increased financial inclusion by providing customers with the freedom to make payments using the method they are most comfortable with. This revolutionary payment solution allows individuals to choose from a range of payment options, including Mpesa, cards, cash, and even digital wallets like Apple Pay and Google Pay.

By offering such diverse payment methods, Pesapal pos terminal eliminates barriers for customers who may not have access to traditional banking services or prefer alternative payment methods. This inclusivity empowers individuals to participate fully in the digital economy and enjoy the convenience of making transactions using their preferred payment method. It promotes financial empowerment, widens the customer base for businesses, and fosters economic growth and prosperity for all.