Businesses must adopt simple, secure, and user-friendly payment solutions to meet their customers' expectations. A payments page is a key component in achieving this goal, and Pesapal offers one of the most reliable solutions for businesses in East Africa.

A payments page is an online interface where customers can securely complete transactions by entering their payment details. Typically integrated with websites, e-commerce platforms, or shared as a standalone payment link, payment pages simplify the checkout process for customers, offering various payment options like mobile money, debit and credit cards.

Introducing the Pesapal Payments Page

The Pesapal Payments Page is a versatile, secure, and customizable solution that allows businesses to collect payments online effortlessly. Whether you’re running an online store, offering professional services, or organizing events, the Pesapal Payments Page enables you to accept payments with minimal technical setup. This user-friendly solution supports diverse payment methods, including M-Pesa, Airtel Money, Visa, and Mastercard, making it accessible to customers across East Africa.

Creating a Pesapal Payments Page is a straightforward process:

1. Sign Up for a Pesapal Account

Visit the Pesapal website and sign up for an account if you don’t already have one.

2. Visit store.pesapal.com

3. Navigate to the Payment Pages Section

After logging in, go to the dashboard and select the “Payments Page” option.

4. Create Your Payment Page

5. Fill in the required details such as page title, description, and amount (if fixed).

6. Customize the page with your logo, banner or branding for a professional appearance.

7. Generate and Share the Link

Once the page is ready, Pesapal generates a unique link you can share with your customers via email, social media, or your website.

Read Also: How to Create Pesapal E-invoice | Pesapal

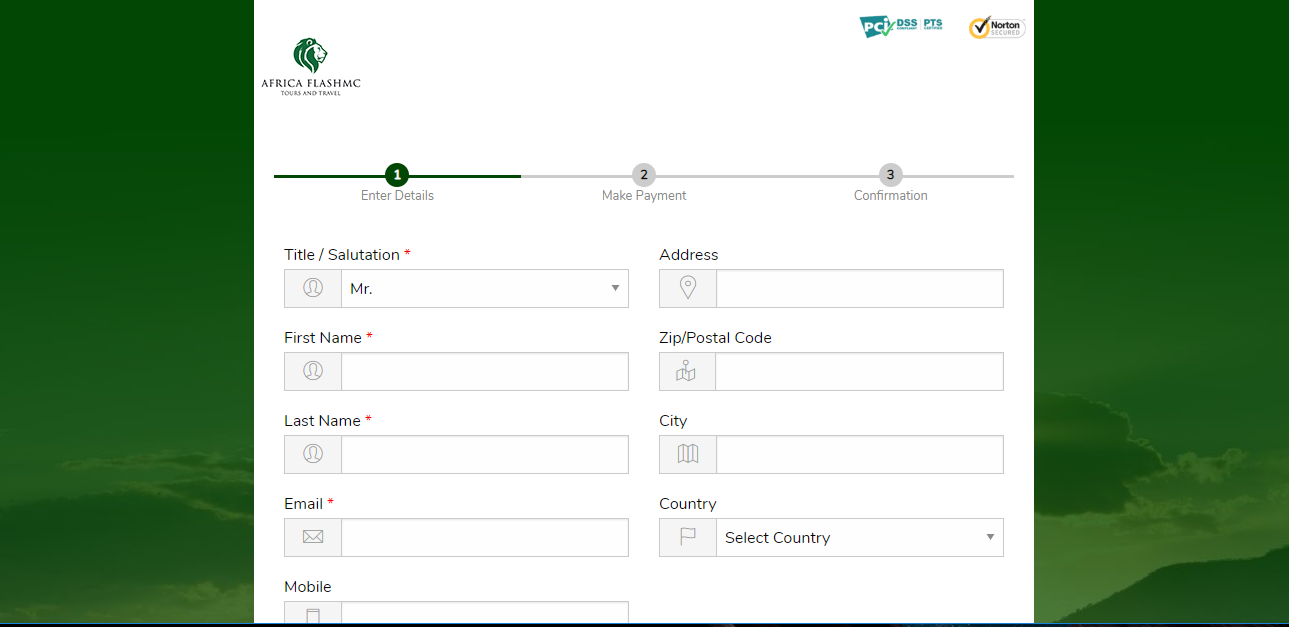

The payment process is complete in just three steps.

The Payments page allows your client to make partial payments (deposits) as well as full payments. We give you another option of customizing your payments page to your liking. As a merchant you have the ability to decide whether you will allow your clients to pay partial or only accepts complete payments.

A payments page provides your clients with the luxury of choosing from a variety of payment options. These include Visa, Mastercard, American Express or Mpesa/ Airtel money in both KES and USD. These multiple payment options offer you clients the flexibility to pay conveniently depending on their reference.

As a merchant you are allowed to choose where you would want the booking icon to be placed. It can be anywhere on your website so as to make it easy for your clients to find it.

Clients are given the option of marking up the transaction fee. This means that some can choose to add the percentage charged for the transaction fee easing you from that cost. The icon can be made visible or not visible depending on what you prefer as a travel agent.

Read Also: Online Invoices

Delivering a smooth guest experience in the hospitality industry goes beyond luxury amenities and picturesque locations. Efficient, secure, and user-friendly payment solutions are integral to ensuring customer satisfaction and operational efficiency. Enashipai Resort in Kenya and Speke Resort in Uganda are exemplary cases of how payments pages can transform business transactions while offering convenience to their clientele.

The Challenge

Enashipai Resort and Speke Resort cater to a diverse customer base, including local and international travelers, event organizers, and corporate clients. However, managing payments posed significant challenges:

Limited Payment Options: Traditional payment methods didn’t cater to all customer needs, especially for international guests.

Complex Payment Processes: Manual payment handling created friction and delays in the booking process.

Security Concerns: Guests sought assurance that their transactions were safe and compliant with global standards.

The Solution: Pesapal Payments Page

To address these challenges, both resorts adopted the Pesapal Payments Page—a secure and flexible solution that simplifies online transactions.

Implementation

Enashipai Resort, Kenya

Enashipai Resort integrated the Pesapal Payments Page to streamline its booking and payment processes. Guests now pay for rooms, spa packages, and conference facilities seamlessly through a customized, branded payments page.

Speke Resort, Uganda

Speke Resort leveraged Pesapal’s platform to handle payments for reservations, event packages, and other services. The payments page provides multiple payment options, catering to both local and global guests.

The Results

Both resorts now offer a frictionless payment process. Guests can pay online using their preferred methods, including mobile money (M-Pesa, Airtel Money), credit cards, or bank transfers. This convenience has significantly improved customer satisfaction.

By enabling quick and secure online payments, the resorts have reduced abandoned bookings and encouraged more customers to finalize their reservations.

The Pesapal Payments Page is PCI-DSS compliant, ensuring every transaction is encrypted and secure. This reassures guests, especially international clients, of the safety of their payments.

With automated payment tracking and detailed reporting through Pesapal’s dashboard, both resorts have streamlined their financial management processes.